Source: 123rf.com

Source: 123rf.com Vulnerable gamblers can now turn to banks for help with their addiction.

By blocking payments, addicted gamblers are prevented from depositing at gaming sites, such as online casinos, online bingo, sports betting, slots sites, and lotto.

The option is currently provided by banking giant Barclays and two digital mobile-only UK banks, Monzo and Starling.

How It Works

Customers can block themselves from a wide range of categories, such as porn sites, online shopping, and gambling.

The ban works on a category level, so customers don't need to block each retailer or operator individually.

Step In The Right Direction

The current self-exclusion offered by gambling sites only works at an operator level. There's no arrangement in place to stop a customer opening a new account at another gambling site unless the same company owns both sites.

The move has been welcomed by gamblers who praised the initiative. Andy Gray, a former gambling addict said:

“It's brilliant. It should be used in school. And every parent should be aware of it,”

Monzo vulnerable customer specialist, Natalie Ledward believes that prevention is the key to helping financial addiction problems, rather than supporting recovery. By blocking customer payments, the bank can lift the threat of spiralling into debt.

Monzo has already reported a 70% decrease in gambling spending since the launch.

Money Advice charities welcome the news and hope more banks will follow suit, believing it will make a real difference to people's lives.

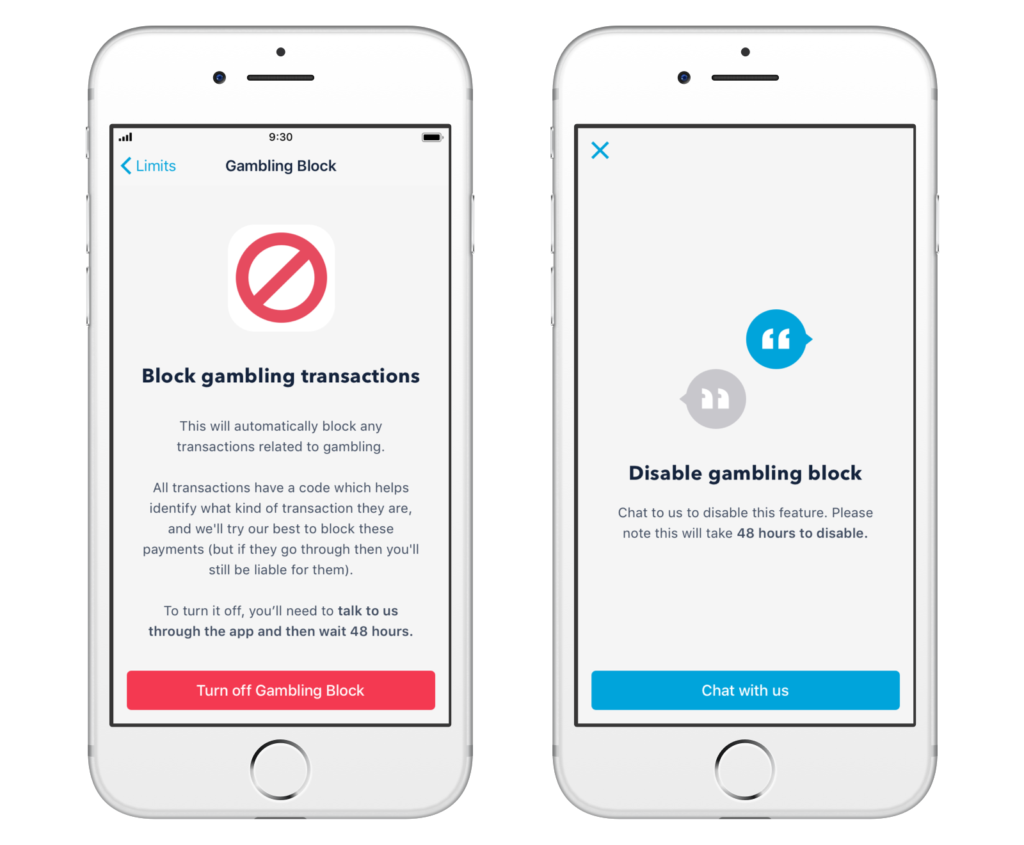

Source: monzo.com

Removing The Block Is Difficult

Removing the payment block is hard by design. Customers must contact the bank's customer service team, and there is a 48-hour pending period.

If a customer decides to play again, he may even be questioned to reduce the risk of gambling harm.

The feature is available with debit cards and pre-paid cards. It is hoped the open will extend to visa cards soon.

Ben has been an massive bingo enthusiast and fan since playing at the seaside as a kid. Dedicated to bringing you the latest and best bingo news from the UK

banks definitely have to do more